OSB Contract Strategy

Matt Meyers

- Thinking

- September 28, 2021

Back-to-Basics: Data-driven OSB Contract Strategies

Weekly or monthly OSB volume contracts can be good business for both the supplier and buyer. The supplier gets predictable takeaway and the buyer gets the guarantee of supply availability as well as the benefit of less volume to negotiate for purchase during the year. With two tumultuous years in OSB markets, you may be wondering how to maximize the value of OSB volume contracts? Here are back-to-basics strategies to inform a data-driven approach and help you cut through the chaos of buying.

There are two important variables in your business to understand before picking a strategy:

Demand: Pull your “out the door” (sold) OSB volume by week, and the total volume for the year divided by 52 weeks. You can pull this data for several years and average the years to smooth the effects of exceptional high and low weeks in any given year, or use a 2-6 week rolling average on one or more years of data. This gives you weekly sales for each week of the year and the average weekly sales volume for the year. Adjust both by the percentage change expected in 2022.

Consistency of demand: Graph your out the door weekly demand projection from above, so you can see its shape (see the example curves below in the strategies section). This graph will help to illustrate your lowest weekly out the door volume and your highest. Important: don’t use your purchased volume or the volume received by week, use the volume you actually shipped “out the door”.

Three strategies:

Once you have the demand data, here are three strategies for determining the contract volume that you want to negotiate.

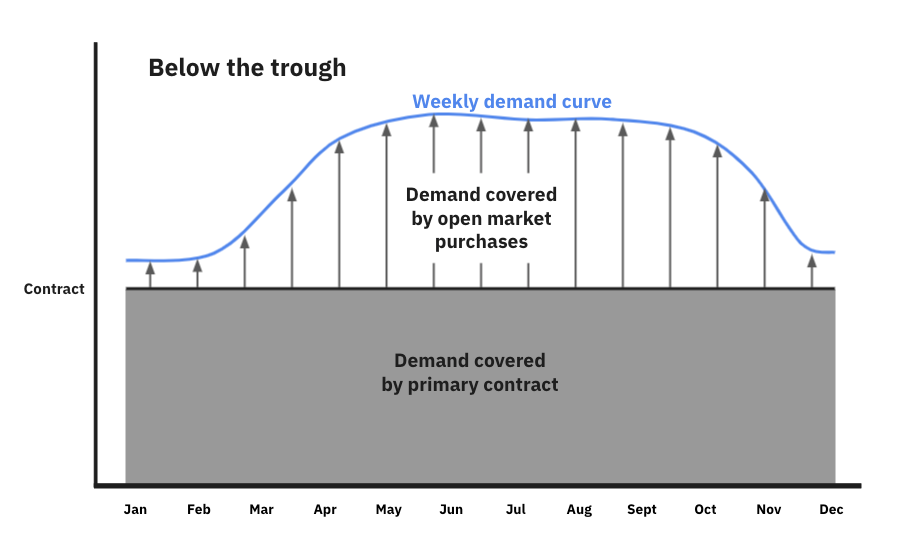

1. Below the trough

Set your contract volume at or below your lowest average weekly volume (round down), then buy into increasing seasonal demand with open market purchases.

Benefits: No requirement to build inventory ahead of demand. More flexibility to buy opportunistically and hedge against your fixed price contracts to builders.

Risks: Finding reasonably priced materials during peak season in low-supply markets.

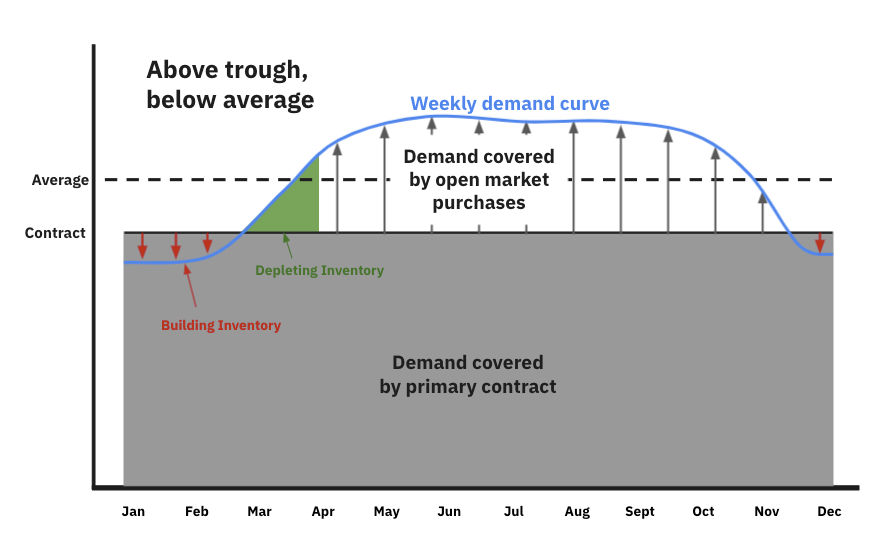

2. Above trough, below average

Set your contract volume above your lowest average weekly volume and below your average annual expected demand.

Benefits: More assurance you can meet your customer requirements, and fewer open market buys in tight markets.

Risks: You need the real estate and operations capacity to build inventory. You may get stuck with excess wood if you contract too close to average and demand drops.

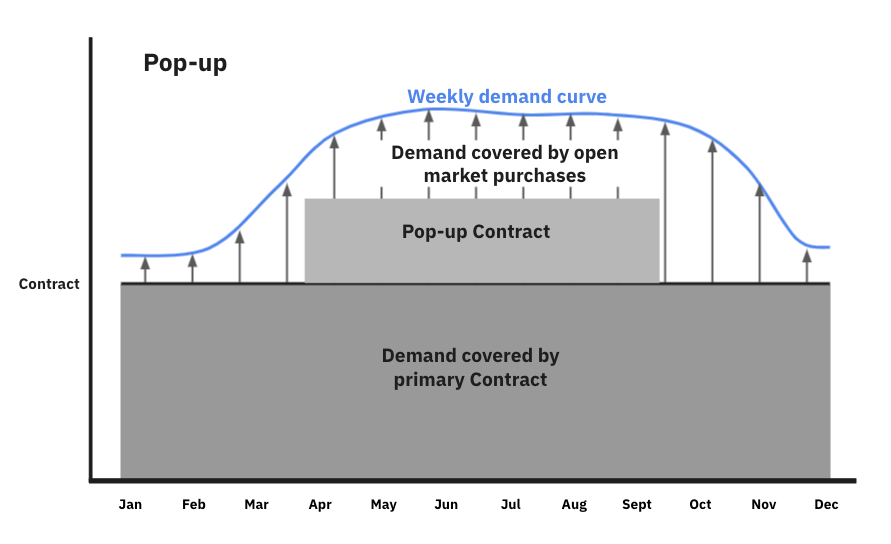

3. Pop-up

Secure one steady volume contract below the trough as described in the first strategy. Set a second, seasonal contract to supplement supply during the peak season. Sure, you may pay a premium for seasonal contracts (as opposed to annual), but you hedge your seasonal volume risks.

Benefit: Less inventory build. Less open market risk in peak markets.

Risk: A likely higher cost of pop-up volume contracts relative to market, and finding a seasonal contract since not every supplier will execute a seasonal agreement.

A Note on Builder Contracts

Before you negotiate your OSB contracts, be sure that you are aware of the structure of pricing contracts you have with significant builders. If you have price contracts with your builders that don’t have the same time frame as your purchasing contract, especially builder contracts with prices set quarterly, this can present risks and opportunities. Your costs will be moving with the market on a weekly or monthly basis while your sale prices will not.

Knowing this sales contract pricing, timing, and volume is important to determining how your purchase contracts create profit risk or opportunity as a buyer.

Summary

Contracts can ensure you stay in supply for your builders, but come with risk. Choosing the right strategy requires more than just instinct. Bad contracts can cost millions. Data is the key to rational decision making that minimizes risk while maximizing profit.

Yesler can help. We are not a producer, broker or buying group, so we don’t have a vested interest in who you buy from. Our interest is putting expertise at your fingertips through Yesler Analytics and the deep experience of our team, sitting beside you (virtually) and providing market intelligence, so you can make the best decisions for your business.