How Can Such High Lumber Prices Fall So Fast?

Matt Meyers

- Thinking

- August 18, 2021

We all know lumber prices are volatile. But how can prices fall so rapidly — even faster than the historic increase in prices in 2020 — along with a rising housing market and during the peak building season?

There are two reasons why lumber prices can fall more rapidly than they rise. First, in a market of rising demand, a buyer’s math compounds multiple factors to add excess inventory and contributes to price inflation. Second, when prices fall, risk of loss dictates one behavior – stop buying.

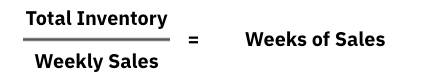

A lumber buyer at a lumber yard uses basic math to figure out what to buy, with key metrics being Weeks of Sales of inventory and the Lead Time to receive new orders.

A buyer works to keep Weeks of Sales at a level greater than the number of weeks it takes to replenish inventory, plus some basic safety stock.

Several issues compound in a rising market causing increases in high cost inventory that ultimately hurts the lumber yard.

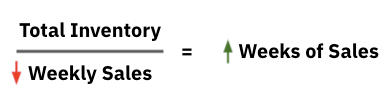

Compounding factor 1 is an increasing pace of sales. This is common during the spring and early summer due to seasonal increase in construction. In math terms, this increases the denominator (Weekly Sales), thus reducing Weeks of Sales in inventory.

To maintain the desired number of expected Weeks of Sales, the buyer must increase the numerator by adding inventory.

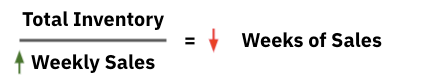

Compounding factor 2 is that as demand on lumber suppliers increases, lead time from suppliers to deliver orders increases as well.

When lead time increases, the buyer must order for the week they originally expected delivery — the “gap week” no longer available to arrive as planned due to extended lead time — plus order for the new week of expected delivery, as illustrated below.

What happened to the missing truck that created the gap week? It was already sold to someone else!

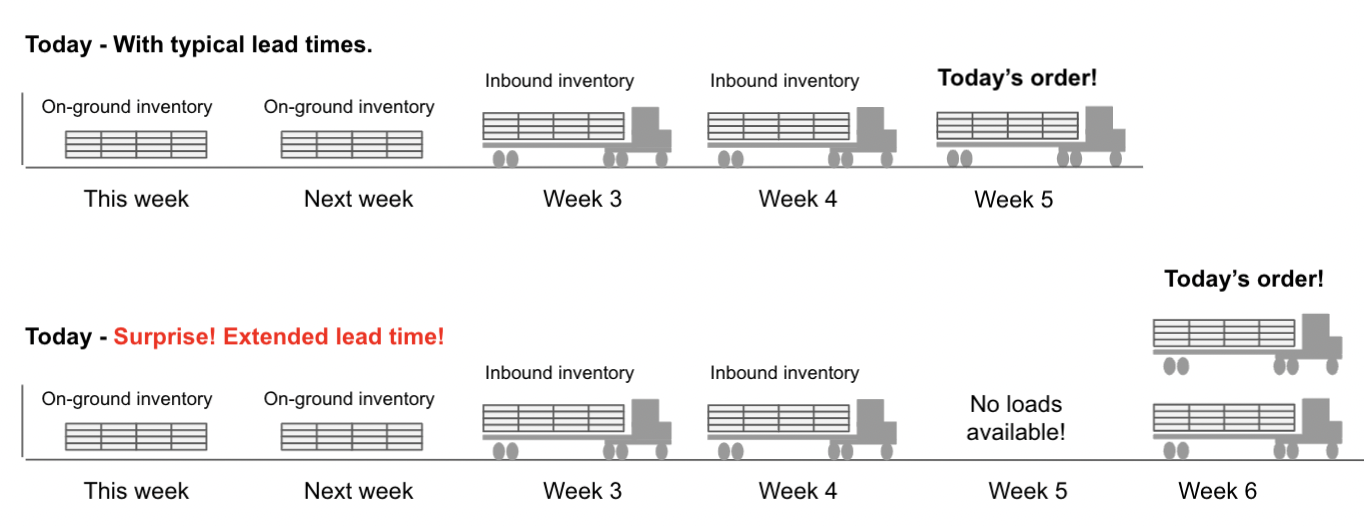

The buyer is now in a cycle of “buying ahead” of increasing and unpredictable lead times. When lead times increase further due to continuing supplier backlogs, this issue continues to compound.

In the example above, the total inventory prior to lead times increasing was 4 trucks, 2 on-ground and 2 inbound. Now the inbound inventory has ballooned to 9 trucks, 2 on-ground and 7 inbound.

Compounding factor 3 is that mills increase price as demand increases. As a result, buyers attempt to get ahead of rising prices by further increasing purchases. Now, not only are buyers adding orders ahead of increasing lead times, they are adding orders to lock-in price ahead of rising and unpredictable prices.

The compounding cycle continues until eventually it is interrupted, usually by a decline or pause in the lumber yard’s Weekly Sales. That pause may be seasonal or driven by a constraint in the supply chain like a labor shortage, or other material shortage not directly affecting lumber, but slowing construction.

When prices start to fall, they can fall fast

Here is how it unwinds. The Weekly Sales pace declines either due to a constraint in some other component of the supply chain (labor, for example) or due to seasonal demand. This increases the Weeks of Sales of inventory beyond supplier lead times, so the buyer doesn’t need to buy.This pause in buying allows suppliers to catch-up on production and have more product on hand for prompt shipment as lumber units begin to stack up in inventory at the mill. Now suppliers lead time begins to contract. What previously took eight or ten weeks from time of order to delivery, now is available for much more prompt delivery.

This pause in buying allows suppliers to catch-up on production and have more product on hand for prompt shipment as lumber units begin to stack up in inventory at the mill. Now suppliers lead time begins to contract. What previously took eight or ten weeks from time of order to delivery, now is available for much more prompt delivery.

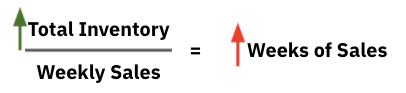

When buyers add up total inventory (on ground plus inbound, which is now the majority of their inventory) in light of now shorter lead times, their Weeks of Sales is too high. And as a result of recent high prices, so is their average inventory cost..

Suppliers, with fewer orders against their production, respond with price decreases to move volume out of their mills. Prices plummet.

The risk of significant financial loss weighs heavily on the lumber yard buyer and their organization, and there is only one rational behavior – stop buying! As a good friend who now leads a major wood products company always says, “nobody wants to catch the falling knife.” Unfortunately, the overpriced trucks booked in the prior weeks continue to arrive like a barrage of daggers popping profit bubbles as the lumber yard’s sale prices plummet with the market to remain competitive.

Buyers need a data-driven plan to outsmart fluctuating markets

Lumber prices will always fluctuate based on supply and demand, but lumber yards can avoid being left short of product in rising markets and avoid being overweight with high-cost inventory in a market pullback. It starts with better math on inventory vs weekly sales – math that accounts for lead time and brings rational analysis into emotionally charged markets.

About Yesler

Yesler helps lumber yards control their supply chain to ensure consistent supply at the right price. It’s not a trading site that accentuates volatility, but a data-driven approach to reduce the impact of volatility at the lumber yard. Yesler uses data to track price and lead time across suppliers, anticipate buyer needs and recommend orders, keeping the buyer ahead of fluctuating markets. It enables analysis, discovery of availability, private communication and negotiation, and confirmation of orders between buyers and their suppliers in one platform.

For more on lumber prices, check out Is OSB Signaling a Free Fall?